Finsane: Budgeting Basics - Mastering Your Money with the 50/30/20 Rule

/

Feeling overwhelmed by your finances? Don't worry, Finsane is here to help! This week, we're diving into the world of budgeting with a popular and powerful tool: the 50/30/20 rule.

What is the 50/30/20 Rule?

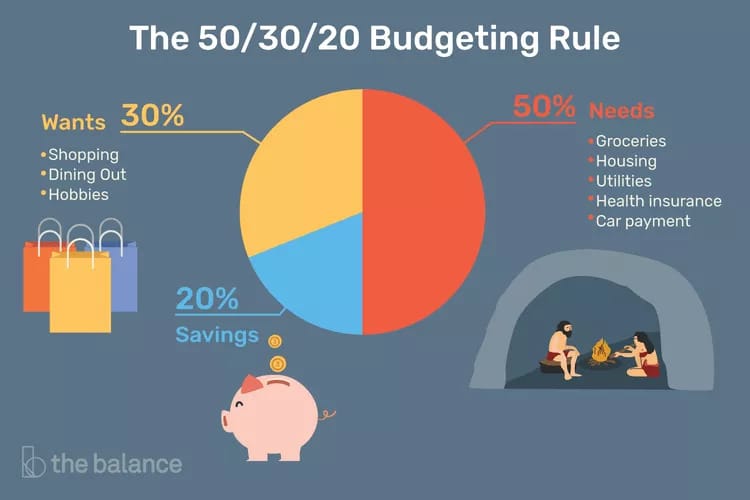

It's a simple yet effective framework for allocating your income. Here's the breakdown:

50% Needs: This covers your essential expenses – rent/mortgage, groceries, utilities, transportation, and minimum debt payments. These are the things you can't live comfortably without.

30% Wants: This is your "fun money" category. It includes dining out, entertainment, hobbies, and subscriptions. Here, you can prioritize what brings you joy within your allotted budget.

20% Savings & Debt Repayment: This crucial portion focuses on your financial future. Allocate funds towards emergency savings, retirement savings, or aggressively paying down debt.

Why Use the 50/30/20 Rule?

Simplicity: It's an easy-to-understand framework that gets you started with budgeting.

Balance: It encourages a healthy balance between essential needs, indulging in your wants, and securing your financial future.

Flexibility: The percentages are a guideline, not a rigid rule. You can adjust them based on your unique circumstances.

Adapting the 50/30/20 Rule for You

Life throws curveballs, and your budget should reflect that. Here's how to personalize the 50/30/20 rule for your situation:

High Housing Costs: If rent or mortgage takes up more than 50%, consider reducing wants or re-evaluating your living situation if possible. Talk to a financial advisor for personalized strategies.

Debt Repayment: Struggling with debt? Increase the savings/debt repayment category to 30% or more and temporarily reduce wants. Remember, eliminating debt is an investment in your future.

Financial Goals: Have a specific goal like a down payment on a house or a dream vacation? Allocate a portion of your "wants" or even "needs" (if possible) towards that goal.

Making it Work:

Track Your Expenses: Understanding where your money goes is crucial. Use budgeting apps or a simple spreadsheet to track income and expenses for a month.

Review and Adjust: Be honest with yourself. Are you overspending in a particular category? Refine your allocations as needed.

Automate Savings: Set up automatic transfers to your savings account to ensure you're consistently building your financial safety net.

Remember: The 50/30/20 rule is a starting point. The key is to find a budgeting system that works for you and helps you achieve your financial goals. Finsane is here to support you on your financial journey, so keep an eye out for our upcoming articles on savings strategies, debt management, and more!